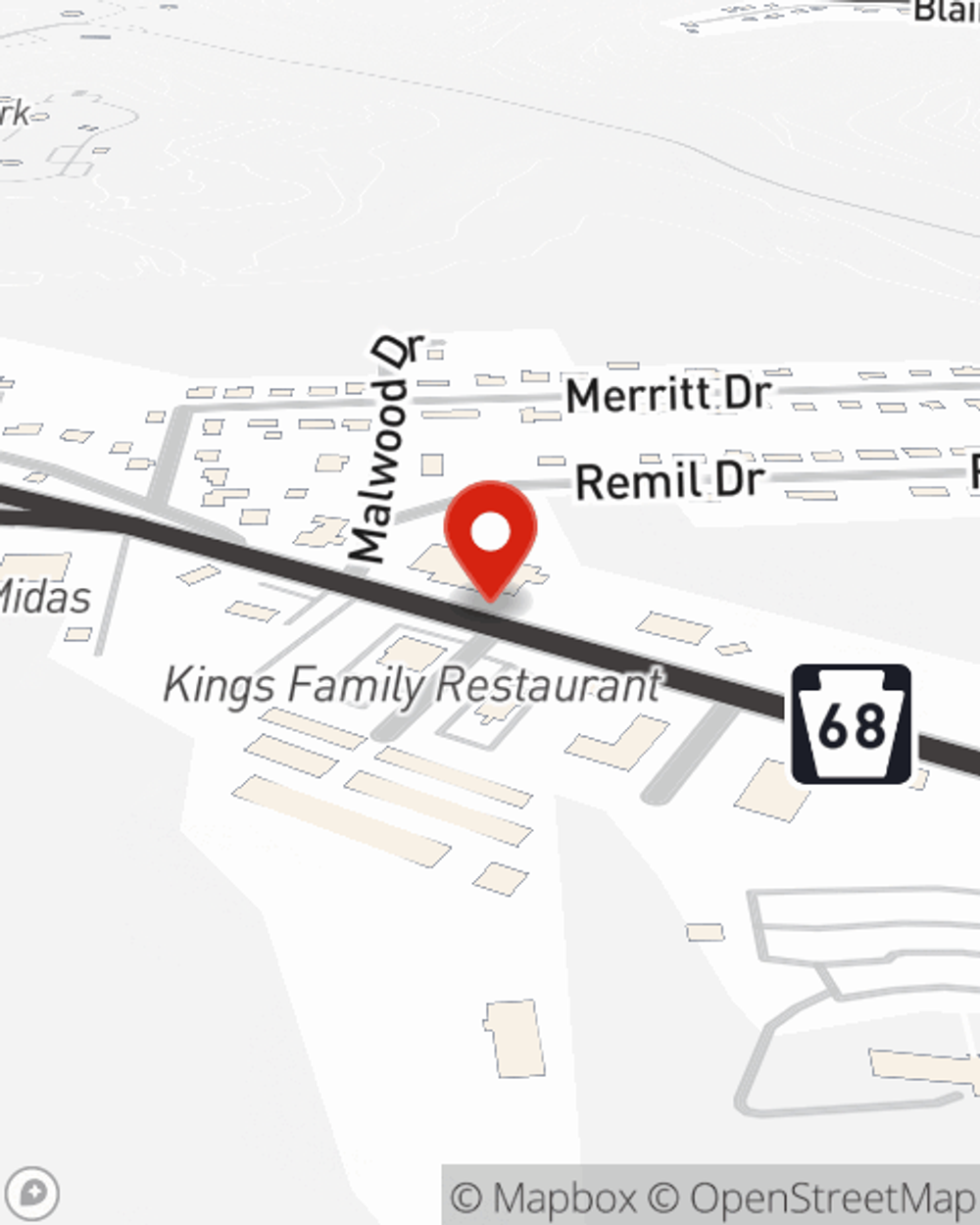

Business Insurance in and around Butler

One of the top small business insurance companies in Butler, and beyond.

No funny business here

- Butler

- Cranberry Twp

- Seven Fields

- Slippery Rock

- Saxonburg

- Wexford

- Mars

- Chicora

- Valencia

- Connoquenessing

- Renfew

- Fenelton

- Prospect

- Evans City

- Zelienople

- Harmony

Insure The Business You've Built.

When you're a business owner, there's so much to focus on. We get it. State Farm agent Mark Reges Jr is a business owner, too. Let Mark Reges Jr help you make sure that your business is properly insured. You won't regret it!

One of the top small business insurance companies in Butler, and beyond.

No funny business here

Small Business Insurance You Can Count On

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a real estate agent or an insurance agent or you own a hobby shop or a pottery shop. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Mark Reges Jr. Mark Reges Jr is the agent who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Contact State Farm agent Mark Reges Jr's team today to get started.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Mark Reges Jr

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.